"If you don’t know where you’re going, you’ll probably wind up somewhere else"

Do You Have Time To Plan?

Typically caught up in our day-to- day work, most of us afford very little time for financial planning.

Moreover, with little access to real time information and lack of ability to interpret, investment decisions just do not feature in our list of priorities.

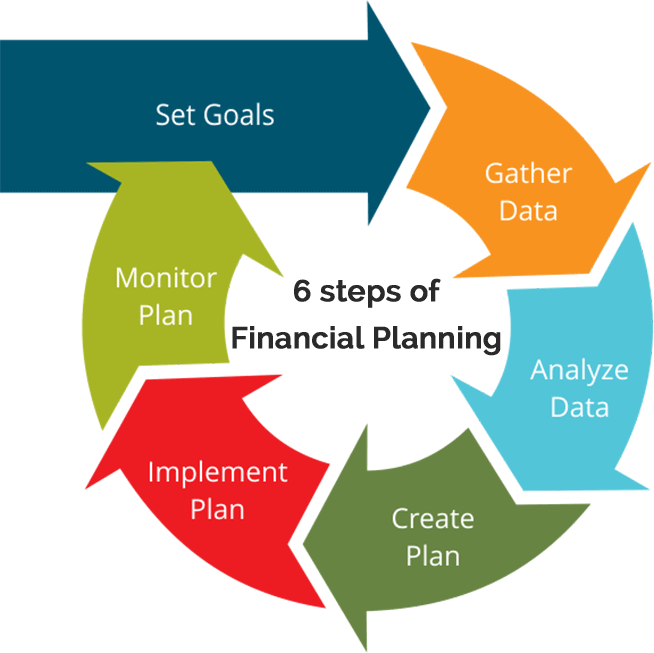

Creating wealth requires discipline and direction by Financial Planner.

A good advisor can turn around your fortunes

Get more organized in

personal finance

Make better financial

decisions

Simplify your

financial life

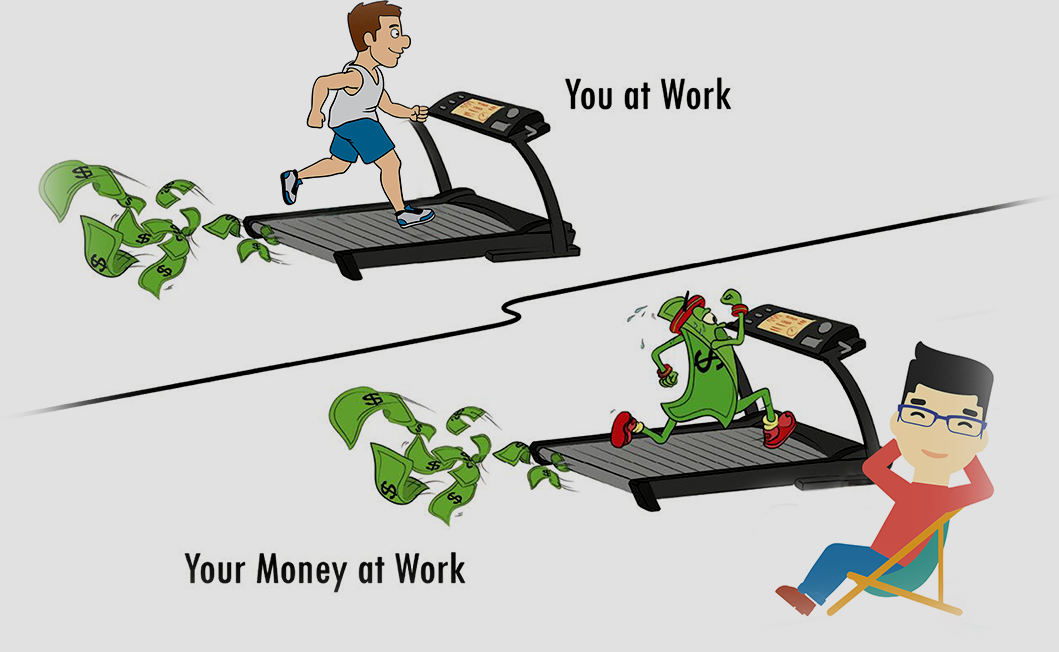

Create and grow

wealth

Our tools make it easier to manage and grow your money